Can I Get Loan After Settlement?

Loan Settlement Services | Credit Card Loan Settlement | Personal Loan Settlement | Vehicle Loan Settlement

In the fast-paced financial world of India, debt settlements are becoming increasingly common. According to TransUnion CIBIL’s 2023 report, over 20 lakh Indians opted for loan settlements in the past 2 years. While it might seem like an immediate fix to overwhelming debt, many people are left wondering, can I get loan after settlement?

This blog aims to answer that question in depth. We'll explore how loan settlements impact your credit profile, your future loan eligibility, legal rights, and most importantly—what you can do to bounce back and regain financial credibility.

What Is Loan Settlement?

The Definition and Legal Context

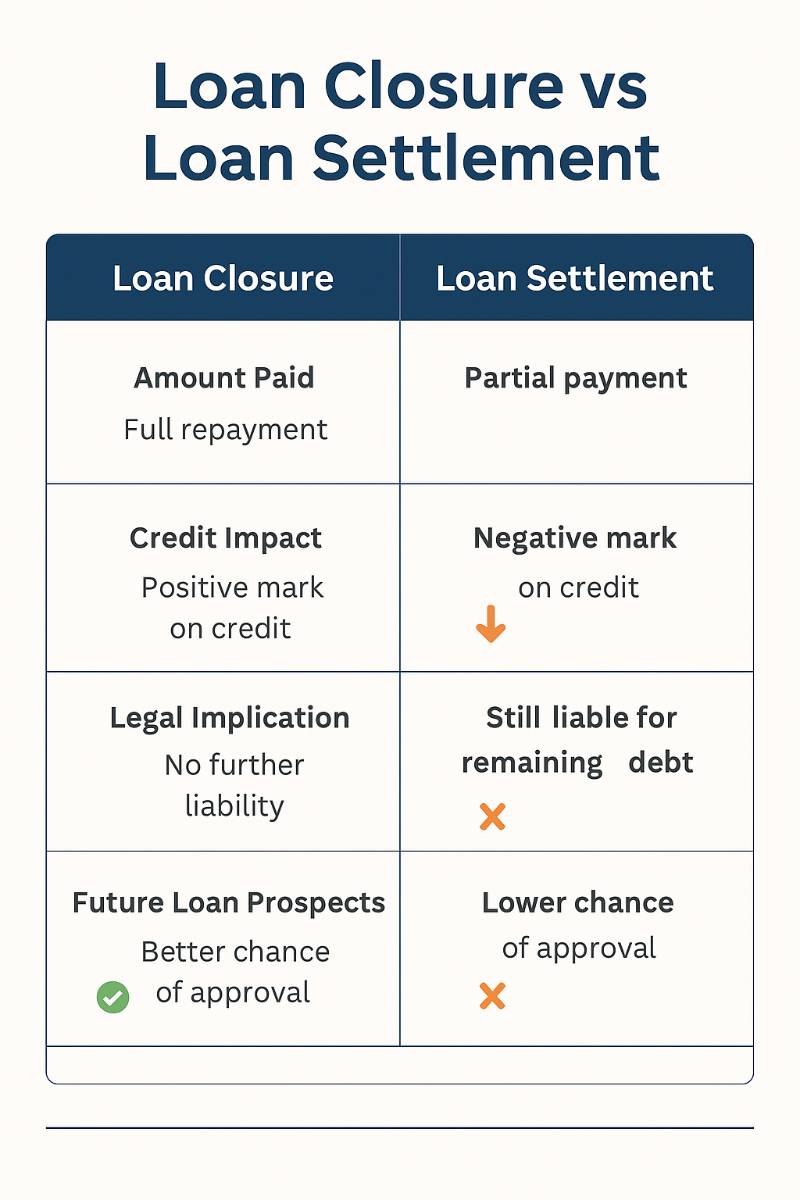

Loan settlement occurs when a borrower, unable to repay the full outstanding balance, negotiates with the bank or lender to accept a reduced amount as a "full and final" payment.

For instance, if you owe ₹5,00,000 and the bank agrees to close your account after you pay ₹3,00,000, that is a loan settlement.

But here’s the catch—your credit report will now show the status as “settled”, not “closed.” This single word carries serious weight in future financial dealings.

Why Settlement Affects Your Creditworthiness

A "settled" loan tells future lenders that you couldn’t fulfill the agreed repayment terms, making you a higher-risk borrower. While it may relieve your immediate burden, it leaves a mark on your CIBIL report and other credit bureau profiles for up to 7 years.

Can I Get Loan After Settlement?

The Short Answer: Yes, But It's Complicated

Yes, you can get loan after settlement, but you’re likely to face rejection or scrutiny from lenders—especially traditional banks. Financial institutions consider a settlement a negative credit event, reducing your overall credit score and affecting their decision-making.

What Lenders See in Your Report

Here’s what typically happens when you apply for a loan after settling a previous one:

Your CIBIL score is often below 650

Your credit report shows the status as “settled”

You may be considered ineligible for unsecured loans

Lenders may offer only high-interest or secured options

Some may ask for a co-borrower or guarantor

If your settlement was recent (within 12–24 months), the chances of loan approval are very low unless you show strong income, security, or positive credit behavior post-settlement.

Types of Loans You Can Get After Settlement

1. Secured Loans

Secured loans are backed by an asset (collateral), making lenders more confident in recovering their funds even if you default.

Common options include:

Loan against property

Gold loan

Loan against fixed deposit (FD)

Loan against insurance

These loans are relatively easier to obtain after settlement, provided you have stable income and updated KYC.

2. NBFC Loans

Non-Banking Financial Companies (NBFCs) often have more flexible credit norms than traditional banks. Although their interest rates are higher, they serve as a good starting point for rebuilding your creditworthiness.

Popular NBFCs offering post-settlement loans in India:

Bajaj Finserv

Tata Capital

Fullerton India

3. Peer-to-Peer (P2P) Lending Platforms

Online P2P platforms allow individuals to borrow directly from private investors. They perform fewer credit checks and are open to borrowers with lower CIBIL scores, making them a feasible option post-settlement.

How Settlement Affects Your CIBIL Score

The Immediate Impact

Settlement negatively impacts your CIBIL score by 75 to 150 points or more. If your score was 750 before the settlement, it may drop to 600 or below immediately.

This reduction is because CIBIL considers a settled account as partially defaulted. It also lowers your “creditworthiness rating,” making fresh loans difficult to secure.

Long-Term Impact

The “settled” tag remains on your report for up to 7 years

It reduces your chances of getting home loans, car loans, or personal loans

Lenders may also deny you credit cards or ask for collateral or co-signers

You can check your CIBIL score for free at CIBIL’s official site

How to Improve CIBIL Score After Settlement

1. Repay Any Remaining Amount (If Possible)

Sometimes, post-settlement, a small balance still remains. Clearing this and requesting a "No Dues Certificate" from your bank helps demonstrate repayment intent.

2. Apply for a Secured Credit Card

Many Indian banks offer secured credit cards against a fixed deposit. These cards are ideal for rebuilding credit as they offer controlled spending with guaranteed approval.

Top secured cards in India:

SBI Advantage Plus

Axis Insta Easy

ICICI Coral Secured

3. Never Miss EMIs Again

Any new loan or EMI must be paid on time. Your goal is to prove consistency in repayments for the next 12–24 months. Even small loans, if repaid well, can help improve your score.

4. Dispute Credit Report Errors

Check your credit report regularly. If the settlement or any payment is wrongly reported, raise a dispute on the CIBIL portal or via your bank.

5. Request “Closed” Status After Full Repayment

If you manage to pay off the remaining dues of a settled account in full, ask your bank to change the status from "settled" to "closed"—a huge boost to your credit reputation.

Legal Perspective: Can Lenders Deny You a Loan Forever?

No, under Indian law, banks cannot blacklist you permanently. Every borrower has the right to rebuild credit and seek future loans.

RBI Guidelines

As per the Reserve Bank of India’s Fair Practice Code, lenders must provide clear reasons for rejection and cannot discriminate indefinitely against settled accounts.

Also, the RBI’s Credit Information Companies (Regulation) Act, 2005 ensures your data must be updated accurately by banks and NBFCs.

At AMA Legal Solutions, we routinely assist clients in getting their credit reports corrected, negotiating with banks, and guiding them to legally restore their loan eligibility post settlement.

How Long Should You Wait to Apply for a Loan After Settlement?

Here’s a practical timeline:

Time Since Settlement | Recommended Action |

|---|---|

0–6 Months | Avoid applying for loans |

6–12 Months | Build CIBIL using secured cards |

12–18 Months | Apply for small secured or NBFC loans |

24+ Months | Apply for personal loan or credit card cautiously |

Visit www.amalegalsolutions.com to connect with legal experts who specialize in debt resolution, credit rebuilding, and legal disputes related to settlement.

Your Loan Journey Doesn’t End With a Settlement

Yes, you can get loan after settlement—but not overnight. The road ahead requires planning, patience, and legal support.

At AMA Legal Solutions, we’ve helped hundreds of clients navigate this path successfully. From negotiating fair terms with lenders to cleaning up credit reports, we’re here to help you rebuild your financial credibility—legally and smartly.

📊 Did you know? Borrowers who improve their CIBIL score from below 600 to above 700 increase their loan approval chances by over 60% within 2 years (as per CIBIL 2024 data).

✅ Don’t let a past settlement define your future.

📞 Contact us now at www.amalegalsolutions.com to book a free consultation.

Frequently Asked Questions

Related Articles

Comprehensive Guide to Legal Services in Chanakyapuri

Explore top-notch legal solutions tailored for Chanakyapuri

Read Article

How to Boost Your CIBIL Score After Loan Settlement: 7 Tips

Essential strategies to enhance your CIBIL score post-loan settlement.

Read Article

Mastering Loan Collection Policies for Optimal Financial Health

Your Guide to Understanding Effective Loan Collection Strategies

Read ArticleAbout Author

Anuj Anand Malik

View ProfileAnuj Anand Malik, Founder of AMA Legal Solutions, is a trusted advocate, loan settlement expert, legal advisor, and banking lawyer. With over a decade of experience in loan settlement, corporate law, financial disputes, and compliance, he leads a result-driven law firm based in India that helps individuals, startups, and businesses achieve legal and financial stability.

Connect on LinkedInNeed Legal Help?

Get expert advice on loan settlement and debt relief.

Call +91-8700343611Request Callback

.png?alt=media&token=b7b24a4d-0f1d-4778-b867-939ad0754913)